Back to the Future Business District

05 April 2024

As Colmore BID enters its fourth term, Mike Best looks back at the longer term impact the pandemic has had on the District, and how our pioneering Future Business District study has helped to shape our response.

Introduction

In the summer of 2020, as we emerged from the first Covid lockdown, Colmore BID posed an existential question – did the Business District have a future?

At that time, our streets and offices were empty – the BID team was all but stood down. Everyone was working from home and our hospitality businesses were on life support.

Throughout 2021, the Future Business District Study was progressed virtually by the City-REDI team from the University of Birmingham and an expert panel chaired by Alex Bishop, joint head of office at Shoosmiths. We didn’t even meet in person until the Future Business District Study was launched in October 2021.

The accompanying Colmore BID report – The Space Between – highlighted thirty propositions that could shape the recovery of the business district.

Just over two years later and its main outcome is the appointment of a ‘City Curator’ which was quickly supported by Birmingham City Council. Much of the Study’s thinking has been absorbed into our 2024-29 Business Plan, Your Future Business District. It is now part of the DNA.

So, what next?

Footfall

March 2024 marks four years since that first lockdown.

Looking back to my 2022 blog, we had been in the grip of the pandemic for two years. The Centre for Cities produced a High Street Recovery Tracker which provided valuable time series data on how city centres were impacted.

Birmingham was in the bottom ten nationwide for footfall for most of those two years. In February 2021, the city centre was experiencing only 16% of pre-pandemic levels of footfall. Even in May 2022, when all restrictions had been lifted, Birmingham was still second bottom to London with 77% of footfall and in the bottom ten for spend (although by then this was at 105% of pre-pandemic levels).

The recovery was uneven, with weekends initially lagging weekdays but since the end of 2021, weekends have driven the recovery with 108% of pre-pandemic footfall compared to weekdays at 81%.

This was evident from the vibrancy of Birmingham’s then resurgent nightlife, even while many venues were still struggling for staff, with so many having left the industry (and in some cases the country).

Commuting

The long-term pre-pandemic trend had been a gradual reduction in car journeys into Birmingham city centre, largely replaced by the train with bus journeys stable but actually dropping during the previous half decade. During the pandemic rail travel suffered the most and dropped behind both car and bus, with trams and bikes still contributing little in real terms.

Transport for West Midlands (TfWM) data showed that rail usage was down as much as 96% in April 2020 and was still about 90% down by Christmas of that year. It had recovered to about 50% down by Freedom Day in June 2021 but then dipped below 50% again in December 2021 when there was another ‘work-from-home’ directive in response to Omicron.

During 2022, this recovered to around a 10% decline on pre-pandemic levels but continuing labour shortages, poor punctuality and reliability of train services was still a major factor in people’s willingness to return to the regular commute.

Statistics from the ORR and TfWM show that by 2023, rail journeys into Snow Hill were still only half of pre-Covid levels, whilst New Street had recovered to about two thirds. Meanwhile, bus journeys in the West Midlands were back to 85% and tram journeys 60% compared to pre-pandemic1 . It is evident that people are not returning to the city centre in the same numbers.

Offices

Colmore Business District is the heart of the professional and financial services community, so the office market is a good barometer of its health.

The Birmingham Office Market Forum (BOMF) reports take up of office space in 2023 of 703,000 sq ft from 109 deals, up on the previous year by 1.5% and 5% on the year before showing steady growth, albeit a third down on the record year of 1M sq ft in 2017. This suggests a reasonably healthy market and good levels of confidence.

KWB’s office market report for Q4 2023 suggests a ‘flight to quality’ trend with organisations looking to “enhance their presence in thriving city centre locations by expanding into modern office space that blends excellent working environments with lifestyle features like gyms and restaurants”. A good example is the Paradise development by MEPC.

The key sectors on the move included professional services, financial services and education/recruitment/training, with legal and civil engineering being the most prominent sub-sectors underpinning the big deals. At the same time, there is an upward trend in smaller occupiers taking space below 3,000 sq ft, accounting for 14% of annual take up.

KWB concluded that “from Colmore Business District to Chamberlain Square and Brindleyplace, occupiers are prioritising buildings with excellent transport links in and out of Birmingham, as well as easy access to retail and other local amenities. As more businesses embrace flexible working, occupiers are adapting accordingly to make hot desking and hybrid working a reality”.

Those headline figures however mask what is happening inside offices, where occupancy levels remain low. Ask-RE reported in January 2024 that occupancy in the UK has recovered to 33.8% in November 2023 from a low of 9.7% in May 2021 when their survey began, with available evidence suggesting pre-pandemic office occupancy was between 60-80% (accounting for external meetings, absences and annual leave).

Many businesses have retained flexible working policies introduced during Covid and Colmore BID’s own survey evidence shows that most people are more likely to be in the city centre on Tuesdays to Thursdays with Fridays being the quietest day.

The apparent strength of the office market is therefore disguising broader trends of how those spaces are being used and by who. We have seen a permanent shift in the way we work.

Hospitality

This shift has had a major impact on the hospitality sector, which had been an increasing feature of Colmore pre-pandemic. After lockdowns and tiers, the sector bounced back in 2022, helped by the hugely successful Birmingham Commonwealth Games which saw tens of thousands of people descend on the city centre and its fan zones.

However, analysis published by City-REDI at the University of Birmingham shows that 1 in 18 hospitality businesses had closed in the year since the Games. Much of the government support to the sector went directly to staff (through the furlough scheme), through grants which assisted landlords, and loans to businesses which has created a debt legacy. Combined with increases in energy costs over the past 18 months, this has been a ‘stay of execution’ and we continue to see closures (albeit with some new openings) being announced particularly since Christmas 2023.

In the Birmingham Economic Review 2023 produced by the Chamber of Commerce, former BID director and owner of Chapter Restaurant in Edgbaston, Ann Tonks said: “hospitality is facing an existential crisis. The impact of soaring costs increases, recruitment difficulties and challenging trading environments make survival for most of us questionable. Without significant support for our sector…. (this) will lead to further mass closures”.

This crisis for the hospitality sector was reflected in the appointments during late 2022 of Night Time Economy Champions for both Birmingham and the West Midlands.

Anecdotally, the night-time economy in Colmore is more likely to be supported by those travelling into the city centre for leisure purposes rather than those already there for work. That means less reliance on the business lunch and after work drinks. However, we have a new community of young professionals experiencing the office for the first time and wanting to network.

So, the picture overall is one of a slow recovery in footfall, boosted by the Commonwealth Games in 2022, a strong superficial performance from the office market masking a new normal where most office workers spend around half the time they did previously actually in the city centre, resulting in challenging trading conditions for hospitality and public transport.

Your Future Business District

Colmore is embarking on its fourth term, 2024-29, with a vision:

“a desirable place for everyone whether you work here, own a business, visit here or live here. We need a top class public realm, fantastic array of food and drink venues, lots to do both day and night. We want businesses and their staff to have lots of ways to engage with one another to innovate and communicate.”

Some of the successes of the past two years, building on ideas from The Space Between, include:

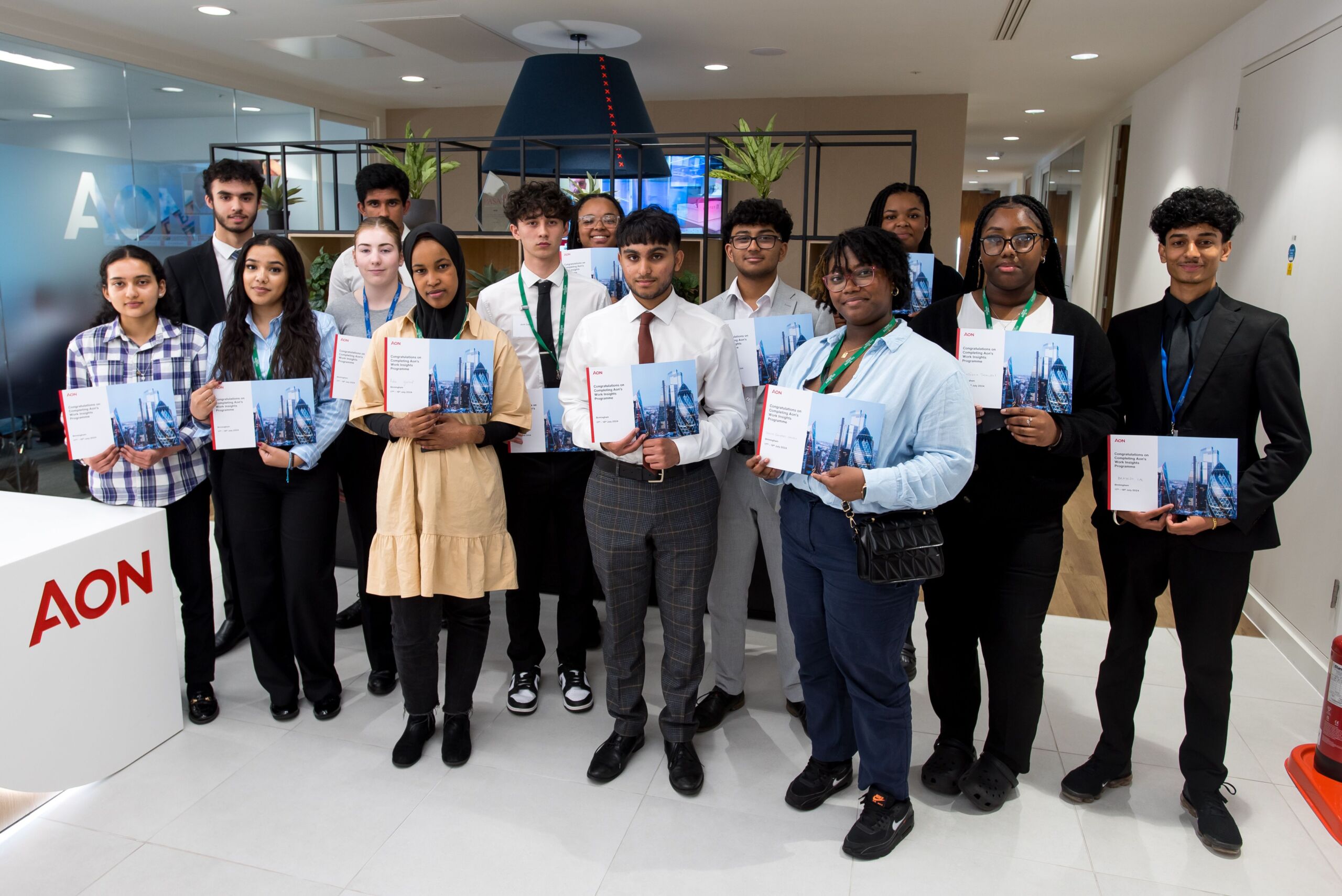

- Welcome to Birmingham, a week of activities designed to appeal to people new to jobs in the city centre, with events and seminars to build their networks

- This has now been extended to a Young Professionals Network

- Regular Network and Drinks events at venues across the area to showcase venues , discuss key topics and enable those working in the district to re-connect

Rolled out the Licensing, Security and Vulnerability Initiative (LSAVI) accreditation scheme to district venues, focussing more on venue specific issues - A Women’s Safety Group is working with other agencies on a broad range of projects to improve actual and perceptions of safety in the city centre.

The Study’s most notable outcome has been the appointment of Alex Nicholson Evans as City Curator. The role is based on the belief that it is the spaces between buildings which give the area its character. They need to be brought to life with better quality public realm, activities and events that attract people to the streets and squares. They need to appeal to the broadest possible constituency, not just office workers but visitors, families and local residents as more build-to-rent homes are created in and around Colmore.

Alex is curating and co-ordinating between various agencies and covering the whole city centre. We are already planning the 100 Days of Creativity programme which will culminate at the Birmingham Weekender event and we have already delivered a small Light Art Installation – Light is Coming.

We are also looking at fostering the 18:7 District concept – a vibrant place 18 hours a day, seven days a week.

We want to find ways of supporting independent businesses in the city centre, with space – including on a temporary basis – business support, relationships with landlords and collective marketing.

We would like to activate more ground floors of buildings and better connect them with the public realm, building on our successful experience with pop-up parklets during the pandemic.

We want to better understand how hybrid working is affecting city centre businesses and how this can be an opportunity for Birmingham to be home to hybrid.

And we want to help deliver new greening and transport initiatives that underpin Colmore’s appeal and people’s confidence.

The business district is different to how it was before the pandemic but the BID is well placed to shape its future over the next five years.

Mike Best, March 2024

- Statistics from the Office of Rail and Road (ORR) show that Snow Hill Station was experiencing peak usage in 2019/20 of 5.6m passenger entries/exits per annum. This dropped to 842,000 in 2020/21 and recovered the following year to 2.3m, rising in the year to March 2023 to 2.7m. It is a similar story for New Street Station, down from a peak of 47m passengers in 2018/19 to 7.3m in 20/21, recovering to 30.7m last year. TfWM statistics show that bus patronage dropped from just short of 250m journeys across the West Midlands in 2019/20 to only 97m in 20/21 and back to 210m in 22/23. Journeys by tram were similarly down from 8m in 2019/20 to 3.4m in 2020/21 and had recovered to 4.8m the following year. ↩︎